This article is designed to offer expert tips and strategies for successfully passing the Financial Management – WGU C214 OA exam. Whether you are a student or a professional aiming to enhance your financial management capabilities, these insights will steer you towards achieving exam success.

...

About Financial Management WGU C214 OA 📖

Before initiating studies on the Financial Management – C214 course, some very basic concepts and principles the course takes into account need to be understood, such as planning and budgeting.

The paper “Financial Management – C214” is a course that delves into necessary financial core values and practices within a firm. This course has been designed to build on students’ knowledge in key financial management concepts applicable to the analytical part of financial statements, decision making, and improvement of financial health in an organization.

Financial Planning: This is a central core idea in the sense that it involves setting objectives, crafting strategy, and creating action plans that will lead to the achievement of the set financial objectives. It is projecting future revenues, expenditures, cash flow estimates, and spotting potentials of financial risks and opportunities.

Financial Budgeting: This is closely linked with financial planning. It involves budgeting for the preparation of a comprehensive financial plan for a specified period, usually a year. This scheme elaborates on projected revenues and costs, including capital expenditure. It is, therefore, important since it aids organizations in making the best use of resources, following up on financial progress, and changing plans in order to meet financial targets.

The student taking up the area of Financial Management – C214 would find them to be critical concepts, for they provide knowledge in how to come up with financial plans and critically evaluate the need to make sound decisions in matters regarding budgeting and financial participation in the strategic management of an organization.

At this juncture, candidates will engage in various skills important to the exam, and focus will tend to address the value each has in securing success in the exams.

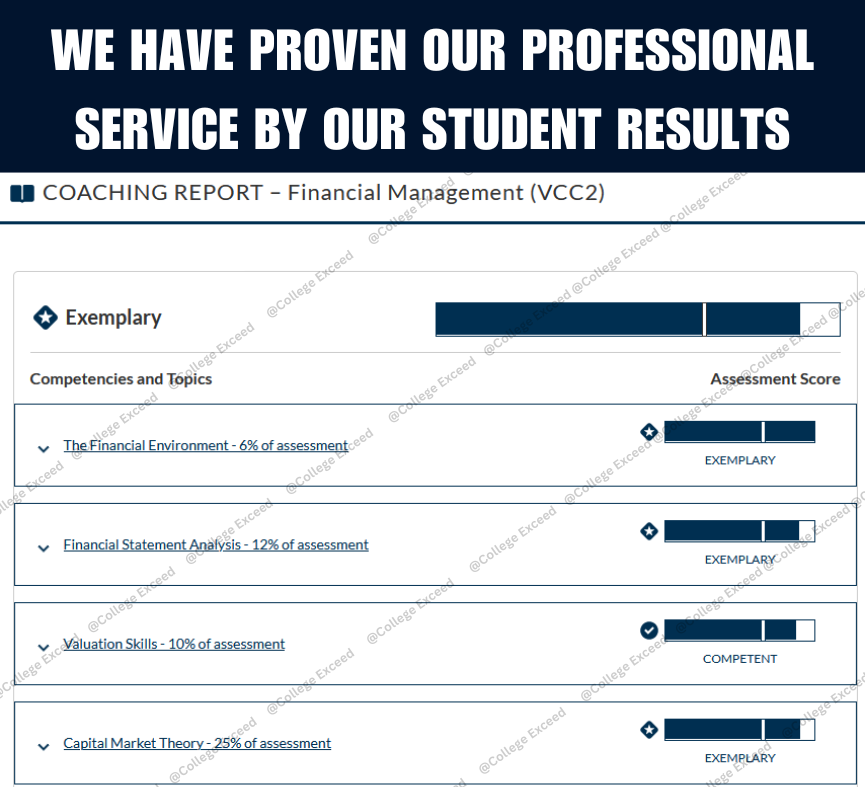

- The Financial Environment 6%

- Competency 3015.1.2: Financial Statement Analysis 12%

- Competency 3015.1.3: Valuation Skills 10%

- Competency 3015.1.4: Capital Market Theory 25%

- Competency 3015.1.5: Long-Term Investment Decisions 22%

- Competency 3015.1.6: Capital Management 19%

- Competency 3015.1.7: Government Regulation 7%

Important!!

Ensure that you have a calculator on hand to excel in this class. Refer to the course materials to identify the permitted types of calculators.

...

What Topics to Focus on Financial Management - WGU C214 OA📝

Our research has pinpointed essential topics for the OA exam in this module. Dedicate time to thoroughly understand these topics before taking the exam. A deep comprehension of these subjects is crucial for excellent performance on the exam and for overall success in the course.

Annual Percentage Yield (APY):

The Annual Percentage Yield (APY) is a percentage measure expressing how much interest is earned in a year on a balance from an account or investment, considering the compound interest effect. This reflects the true return on investment over a one-year period, taking into account both the effects of compound interest and simple interest. In simpler words, interest in compound interest is calculated not on the actual amount, or what is known as the principal or original sum of money, but also on the interest that has been accumulating in prior periods. APY is a crucial basis for comparison between offered investment options or savings accounts, helping investors and savers to establish the actual value when comparing different offered options.

IRR – Internal Rate of Return:

IRR (Internal Rate of Return) is one of the appraisal tools in financial management used to judge the profitability of the project. It indicates the rate of discount at which the net present value (NPV) of the investment becomes zero. Put in another way, IRR aids the investor in scrutinizing the estimated return from an investment since it mainly establishes the growth percentage that a project would likely be in a position to generate. A higher IRR, therefore, gives a more attractive investment opportunity, as it is the higher rate of return compared to the rate given in investment opportunities.

NPV – Net Present Value:

The Net Present Value (NPV) is a financial metric for evaluating the present worth by discounting back to the present value any investment’s cash inflows in a series of future cash flows at a given rate of discounting. This helps the investor to judge the question of whether an investment could result in a positive return and whether it’s worth pursuing. A positive NPV means the investment is assured of producing more cash inflows than outflows. It is, therefore, considered viable financially. On the other hand, a negative NPV values the investment at the current market price, indicating that the investment will make a loss and may hence not be advisable, unless there are other strategic reasons to pursue it. This aspect makes NPV part of the company’s consideration in decision-making and part of the capital budgeting process in making decisions regarding investments.

Time Value of Money (TVM):

Time Value of Money (TVM) is one of the important concepts that relate to either the principle of financing or any branch of finance and refers to money available today being more worthy than the same amount of money in the future either because of its earnings capacity or purchasing power. TVM assumes that the dollar to be received today can be invested in such a way that it earns interest or returns over time. Equally important, the fact that every dollar to be received at some future point in time is therefore worth less than the dollar received today because it is not received until some future date.

It lies at the base of most calculations of finance, such as estimating the present value of future cash flows, finding loan payments, and valuing investment opportunities. TVM principles allow individuals and businesses to make informed financial decisions by comparing the value of cash flows that occur at different points in time.

Understanding TVM helps investors measure not only how much they have made in an investment but also figure out what would be fair terms for a loan. This, therefore, implies that taking into consideration the time value of money allows both individuals and organizations to have the best financial strategies that ensure the best optimum value from the resources at one’s disposal in due time.

Bonds and stocks:

Bonds and stocks are the only two types of investments that can be available to an individual or a business in order to have money accrue towards reaching goals

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. In bond markets, if an investor buys a bond, it is similar to a loaning transaction to the issuer for receipt of coupon payments and repayment of the principal amount at maturity. Generally, bonds will have fixed interests with a fixed date of maturity, so relatively, the case of forecasting an income stream that will be received over the life of the bond is easy. Most importantly, they are considered much safer investments than shares because they offer a fixed income that is well guaranteed by the issuer’s ability to pay the debt. However, it is after the change of interest rates and credit risks because it affects the market value of the bond.

Stocks: Stocks, also known as equities, represent ownership shares in a publicly traded company. Any investor purchasing such stocks becomes a shareholder of the respective company and thus enjoys part of the company’s profits through dividends and part-time benefits even if the stocks appreciate in future values. Unlike bonds, stocks are not fixed instruments, and their return usually continues to fluctuate with the price valuation, company performance, and market conditions and sentiment of the investor. Stocks, on the other hand, provide a chance for an increase in returns vis-à-vis bonds but, on the other hand, come with higher risks due to market fluctuation and, therefore, the possibility of loss of the principal investment.

Both bonds and stocks play crucial roles in investment portfolios, offering diversification benefits and different risk-return profiles. Investors often choose between bonds and stocks based on their investment objectives, risk tolerance, and time horizon. By carefully allocating their investment capital between bonds and stocks, individuals can build balanced portfolios that align with their financial goals and risk preferences.

What External Resources to Use for Studying? 📂

Apart from the course materials, some of the best resources that former students of this course have said were very helpful in preparing to take the OA (Objective Assessment) of Financial Management WGU C214 include: This may include online practice quizzes, textbooks, and course study guides that give more details along the major concepts taught. You may also join groups of other students in the same class or discuss with your tutor to derive more insights into difficult topics. Use these additional resources in conjunction with the course material to prepare yourself better and increase the likelihood of passing the OA exam successfully.

...

What Study Plan to Follow for the Financial Management WGU C214 OA?👨🏻🎓

We’ve crafted a comprehensive study guide based on the valuable input from former students and our own thorough research. Following the instructions outlined in this guide is highly recommended to maximize your learning experience and prepare effectively for the course. By adhering closely to the guidance provided, you’ll be better equipped to grasp the core concepts, tackle challenging topics, and excel in your studies. Let this study guide be your roadmap to success in Financial Management WGU C214.

- Step 1: Videos + Course Material

In this course, WGU offers an ETextbook as the main study material. However, we’ve noticed that this ETextbook might be overwhelming, especially if you’re new to the subject. So, here’s a tip to kickstart your learning journey: begin by watching the three recorded webinar sessions by Dr. Hartzog available in the video library. These sessions cover all the topics you’ll encounter in the module, making it easier to understand the material.

While watching the videos, try out the calculations yourself whenever they come up. If you’re not familiar with using a calculator, there are helpful videos at the bottom of the resources section on “how to work a BA calculator.”

Remember, it’s crucial to grasp the concepts clearly. This understanding will make it much easier to tackle the formulas and calculations in the module. Plus, don’t stress about memorizing all the formulas – you can easily find them in a PDF format in the course search section. This list will also be available during your assessments, so focus on understanding how to apply them effectively.

Once you feel confident with the concepts and formulas, you can further enhance your skills by watching Ray’s concept and calculation videos provided in the course search. These resources will help you practice and reinforce what you’ve learned.

- Step 2: Bootcamp + Glossary of terms

After you’ve gone through the webinar sessions and practiced your skills, we suggest watching the bootcamp video available in the course search section. This video serves as a helpful review, allowing you to revisit each topic and reinforce your understanding of the key concepts.

Additionally, take advantage of the glossary of terms provided in a PDF format within the course section. This document is a valuable resource, compiling all the important keywords essential for this module. Consider printing out this document and dedicating some time to memorize these keywords. Familiarizing yourself with these terms will greatly benefit you when tackling the Objective Assessment (OA).

- Step 3: Study Guide problems Review + PA

After completing the bootcamp video and familiarizing yourself with the glossary of terms, it’s time to reinforce your understanding by reviewing the problems and quizzes provided in the study guide. This will serve as a final revision of your knowledge before you tackle the Pre-Assessment (Pre-A) of this module.

Approach the Pre-A as if it were the real test. This mindset will help you assess your knowledge and identify any weak points that require further attention. Don’t hesitate to take the Pre-A, as you’ve already utilized all the necessary resources to prepare yourself for success. Trust in your preparation and use the Pre-A as a tool to gauge your readiness for the actual assessment.

- Step 4: Coaching guide + Quizlets

After completing the Pre-Assessment (Pre-A), you’ll receive a coaching guide automatically generated for you. This guide is invaluable as it helps you understand your weak points and identifies any mistakes made during the Pre-A. Take the time to carefully review the coaching guide and revisit the topics where you scored lower.

If you didn’t pass the Pre-A on your first attempt, don’t be discouraged. Use the coaching guide to pinpoint areas for improvement and attempt the Pre-A again with renewed focus.

If you’ve successfully passed the Pre-A, congratulations! You’re now ready to sit for the Objective Assessment (OA). Before scheduling the OA, we recommend taking some time to go through the quizlets mentioned in the external resources section of this article. These quizlets are specifically tailored to the OA questions and can greatly enhance your preparation.

With thorough preparation and diligent review of the coaching guide and external resources, you’ll be well-equipped to excel in the OA and demonstrate your mastery of the course material. Best of luck on your assessment journey!

- Step 5: OA

Now that you’ve completed all the necessary steps, you’re fully prepared to tackle the Objective Assessment (OA) with confidence. Our shared tips have equipped you with the knowledge and skills needed to excel in your exam.

During the exam, remember that time management is crucial. Pace yourself and allocate sufficient time for each question or section. If you encounter a challenging question, remain calm and move on to the next one. You can always come back to it later. Trust in your preparation and problem-solving abilities.

Read each question carefully and approach them strategically. Utilize your critical thinking skills to eliminate incorrect choices and determine the most appropriate answer.

With your thorough preparation and analytical capabilities, you’re well-equipped to perform your best in the exam. Good luck! You’ve got this!

...

Conclusion 📄

By adhering to the expert tips and strategies outlined in this article, you are poised for success in the Financial Management – C214 OA exam. Understanding the fundamental concepts of financial management, establishing a well-organized study routine, honing your skills through practice with sample questions, and making effective use of available resources are all pivotal components of your preparation journey. With dedication and perseverance, you have the tools needed to confidently navigate the exam and attain excellence in financial management. Best of luck on your exam!

...