WGU C214 OA Study Guide - 2025 | Understanding Risk, CAPM, and Core Financial Principles📖

Let’s face it—finance can sometimes feel like an endless maze of numbers, acronyms, and formulas. But if you want to make smart financial decisions (and ace your WGU C214 OA questions), understanding a few key principles can make all the difference. Whether you’re a student, an aspiring investor, or just someone who wants to understand how money works, grasping the concepts of Risk and the Capital Asset Pricing Model (CAPM), Types of Risk, and Core Financial Principles is essential.

This article explores three fundamental financial concepts that are essential for understanding investment decisions, risk management, and corporate finance:

- Risk and the Capital Asset Pricing Model (CAPM): Risk is an inherent part of investing, and the Capital Asset Pricing Model (CAPM) helps investors assess the expected return of an asset based on its risk level. It considers factors like the risk-free rate, market risk premium, and the asset’s beta.

- Types of Risk (Systematic Risk, Idiosyncratic Risk): Investors face different types of risks. Systematic risk affects the entire market (e.g., economic recessions), while idiosyncratic risk is specific to a company or industry (e.g., poor management decisions). Understanding these risks helps in making informed investment choices.

- Core Financial Principles: Financial decision-making relies on key principles like the Time Value of Money (TVM), which emphasizes that money today is worth more than in the future; Weighted Average Cost of Capital (WACC), which measures a company’s cost of financing; and Net Present Value (NPV), which helps evaluate investment profitability.

The guide simplifies complex financial principles into basic understandable information which enables readers to feel confident during their finance-related journey. The upcoming content will make these principles easy to understand while also transforming them into interesting knowledge points!

How to Use This Guide for the WGU C214 OA Exam?📖

The C214 Financial Management OA exam at WGU evaluates your understanding of financial decision-making, investment risk analysis, and core financial principles. This guide simplifies the key concepts of risk and the Capital Asset Pricing Model (CAPM), types of risk (Systematic Risk, Idiosyncratic Risk), and core financial principles (Time Value of Money (TVM), Weighted Average Cost of Capital (WACC), Net Present Value (NPV)) to help you grasp the topics tested in the exam.

We also provide exam-style questions and practical applications to ensure you’re fully prepared for the questions on the WGU C214 OA exam.

Risk and the Capital Asset Pricing Model (CAPM) For C214 OA📝

Every investor faces risk as their main concern during investment decisions. An approach to measuring if a particular investment offers value exists beyond doubt. Methodologies exist to identify when we should restrain ourselves from taking excessive risks. Through the Capital Asset Pricing Model (CAPM) investors can determine future returns from their investments because risk provides essential calculation inputs. Recognition of this concept stands essential for financial decision-making and therefore plays a crucial role in the WGU C214 curriculum.

Understanding Risk

Before diving into CAPM, let’s first understand risk. Risk is the possibility that investment might not give the returns we expect or worse, we might lose money. There are two primary types of risk:

- Systematic Risk (Market Risk): This form of risk influences the entire market space and remains impossible to eliminate. Economic recessions together with inflation and global financial crises represent some examples of systematic risk. All investors need to face systematic risk yet they should protect themselves by investing across multiple sectors.

- Idiosyncratic Risk (Specific Risk): This risk is tied to a particular company or asset and can be reduced through diversification. Examples include a company’s poor management decisions or declining product sales. Since it is specific to a company or sector, investors can manage it by investing in a variety of assets.

What is CAPM?

The Capital Asset Pricing Model (CAPM) provides finance professionals with a calculation to estimate investment returns based on their corresponding levels of risk. Financial investors rely on this model to determine stock and investment prospects. CAPM helps companies decide on funding strategies, and it plays a crucial role in WGU C214 OA questions related to financial management.

The CAPM Formula

CAPM is expressed mathematically as:

Ke=rf+β(rm-rf)

Where:

- Ke = Expected return on an asset

- rf = Risk-free rate (usually government bonds or treasury bills)

- β (Beta) = A measure of an asset’s volatility compared to the market

- rm = Expected market return

- (rm – rf) = Market risk premium (extra return investors demand for taking on risk)

Components of CAPM

1. Expected Return (Ke)

Investors expect to obtain this return on their investment. Investors rely on it as the essential solution produced by the CAPM model for making decisions about investments.

2. Risk-Free Rate (rf)

Financiers consider U.S. Treasury bills and government bonds risk-free assets that generate no security-related returns. The benchmark helps measure how much danger exists within an investment framework. The high-security rating on government bonds makes them serve as the reference point for measuring other investment’s value.

3. Beta (β)

Beta measures how volatile an asset is compared to the overall market.

- β > 1: The asset is more volatile than the market (riskier investment). Stocks with high beta can yield high returns but also come with greater risk.

- β < 1: The asset is less volatile than the market (safer investment). Such investments may not provide high returns but are more stable.

- β = 1: The asset moves in sync with the market.

4. Equity Risk Premium (ERP)

Investors seek an additional profit premium to accept stock market investments instead of riskless financial instruments. A premium payment exists to make up for accepting higher risks associated with market-based investments.

Why is CAPM Important For C214 OA?

CAPM is widely used in finance for various purposes:

- Estimating Expected Returns – Helps investors decide if an investment is worth the risk. Knowing the expected return allows them to compare different investment options.

- Capital Budgeting – Companies leverage CAPM to decide equity costs for their long-term investment planning. Businesses employ CAPM as an assessment tool for potential projects and their profitability determination.

- Portfolio Management – Assists investors in balancing risk and return while building an investment portfolio. By knowing the beta values of stocks, investors can create a diversified portfolio to reduce risk.

- Asset Pricing – The estimation of stock fair value depends on its associated risk level. Stock investors depend on this model to make smart decisions regarding their investments.

- Investment Strategies – Guides investors in making risk-adjusted investment decisions. CAPM helps in deciding between aggressive and conservative investment strategies.

Real-World Application of CAPM

CAPM is widely used in real-world finance. Companies use it to assess their cost of equity when making financing decisions. For instance, when a company raises money by issuing stocks, it needs to determine the rate of return investors expect. CAPM helps calculate this rate.

Professional portfolio managers depend on CAPM principles to create decisions regarding asset investment distribution. Organizations use expected returns analysis to judge how much return their financial assets will provide relative to their accepted risk threshold.

Limitations of CAPM

While CAPM is a useful model, it does have some limitations:

- Assumes all investors make rational decisions, which is not always true. Market fluctuations often result from investor emotions, news, and speculation.

- Assumes risk can be perfectly measured using beta, but other factors also affect investments. Some companies may have hidden risks that beta does not capture.

- Market returns are unpredictable, making assumptions in the model uncertain. While CAPM provides an estimate, real-world returns may vary due to external economic events.

- Not all investments fit the CAPM model, especially those in emerging markets or unique industries with unconventional risks.

Systematic risk and idiosyncratic risk serve as fundamental concepts for investment strategies in WGU C214 OA questions and should be comprehended before exploring financial management.

Types of Risk: Systematic Risk and Idiosyncratic Risk For C214 OA📝

All investors must accept risks when investing yet risks differ in magnitude. Market-wide risk factors exist as well as risks that affect individual companies or their respective industries. Successful investment decision-making requires students to distinguish systematic risk from idiosyncratic risk. The core elements of WGU C214 serve to guide investors who want to handle their investment portfolios successfully.

Systematic Risk: The Market-Wide Risk

Market or non-diversifiable risk affects every corner of the economy and substantial financial market segments throughout the entire market. Such risk results from macroeconomic factors that investors cannot regulate by spreading their investments across different assets. All investors need to plan for systematic risk since this type of market-wide factor affects every financial investment.

Causes of Systematic Risk:

- Interest Rate Risk: Changes in interest rates affect the cost of borrowing and the value of investments, particularly bonds. When interest rates rise, bond prices tend to fall, making fixed-income investments riskier.

- Inflation Risk: Rising inflation reduces the purchasing power of money and erodes investment returns. If inflation rates are higher than expected, investments that do not offer inflation-adjusted returns may lose value.

- Recession Risk: A weakening economy occurs through business results which generate limited profits and declining customer purchases resulting in declining stock market values. Recessions induce market downturns during which investors find it extremely challenging to transform their investments into profitable results.

- Geopolitical Risk: Global financial markets undergo tremors from wars plus trade disputes along with politically unstable conditions. Major economies fighting trade wars create unstable stock prices that strengthen exchange rate variations.

Deterioration affecting the entire market makes systematic risk an irreversible aspect so diversification strategies do not decrease its effects. Investors can handle systematic risk using asset allocation by sharing their funds across stocks bonds and commodities because these asset types move in different ways during market variability.

Portfolio protection against market downturns can be achieved through purchasing options and investing in assets including gold and real estate by means of hedging strategies.

Idiosyncratic Risk: The Company-Specific Risk

Idiosyncratic risk, also called specific risk, diversifiable risk, or unsystematic risk, is associated with individual companies, industries, or sectors. Unlike systematic risk, this type of risk can be reduced or even eliminated through diversification.

Causes of Idiosyncratic Risk:

- Management Decisions: Poor leadership, financial mismanagement, or strategic mistakes can negatively impact a company’s stock price. For example, a company that expands too aggressively without proper planning might suffer financial distress.

- Operational Issues: Production failures, labor strikes, or supply chain disruptions can create volatility for a company’s stock. A company dependent on a single supplier may face challenges if the supplier encounters financial difficulties.

- Regulatory Changes: Government policies and industry regulations may affect specific businesses differently. For instance, stricter environmental regulations could impact manufacturing companies, while technology firms may face data privacy laws.

- Competitive Threats: Market position threats occur for companies whenever competing firms launch operations and customers adjust their preferences alongside technological disruptions. Organizations that avoid innovation will forfeit their market control to competitors who operate their business with speed and flexibility.

By investing in a diversified portfolio, investors can reduce idiosyncratic risk. If one company or industry faces trouble, the overall impact on the portfolio remains limited. For instance, an investor who holds stocks in multiple industries—such as technology, healthcare, and consumer goods—can cushion losses in one sector with gains in another.

Comparing Systematic and Idiosyncratic Risk

Feature | Systematic Risk | Idiosyncratic Risk |

Definition | Affects the entire market | Specific to a company or industry |

Diversifiable? | No | Yes |

Examples | Interest rates, inflation, recessions | Poor management, lawsuits, product recalls |

Mitigation | Asset allocation, hedging | Diversification, research |

The Role of Diversification in Risk Management

The strategy of distributing investments to various assets creates a risk-mitigation effect against unpredicted individual market fluctuations. Investors who spread their funds across different stock industries in addition to bonds and other financial instruments can make their portfolios less vulnerable to individual company losses.

A retail company shareholder might simultaneously own technology sector investments and healthcare sector investments. A decline experienced by the retail company because of weak consumer spending can be balanced by increased value in the technology or healthcare sectors.

The elimination of systematic risk becomes impossible thus companies must use hedging strategies and defensive stock investments together with options contracts to reduce potential losses.

Time Value of Money (TVM) Weighted Average Cost of Capital (WACC) and Net Present Value (NPV) serve as vital financial concepts for decision-making based on WGU C214 OA questions.

Tired of reading blog articles?

Let’s Watch Our Free WGU C214 Practice Questions Video Below!

Core Financial Principles For C214 OA: Time Value of Money (TVM), Weighted Average Cost of Capital (WACC), and Net Present Value (NPV)📖

The understanding of foundational financial principles enables people to make better business and investment choices through evidence-based determination. As crucial elements in financial management and investment analysis developers use the Time Value of Money (TVM) together with the Weighted Average Cost of Capital (WACC) as well as Net Present Value (NPV). The principles serve an essential function for capital budgeting alongside financial planning and investment value assessment which lead to their crucial role in WGU C214.

Time Value of Money (TVM)

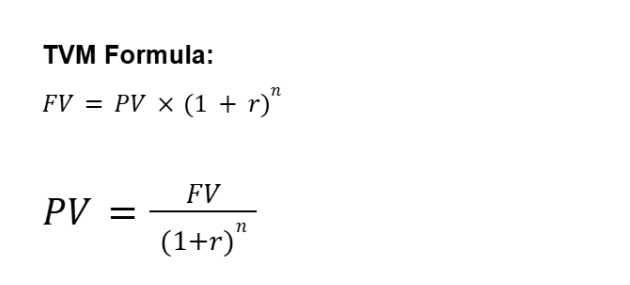

The Time Value of Money (TVM) is a fundamental concept in finance that states that money today is worth more than the same amount in the future. This is because money can be invested to earn returns over time. Understanding TVM helps investors and companies make decisions about investments, savings, loans, and retirement planning.

Key Concepts of TVM:

- Present Value (PV): The current worth of a future sum of money, discounted at a specific rate.

- Future Value (FV): The amount an investment will grow to after earning interest over a period.

- Discount Rate: The rate at which future cash flows are adjusted to determine present value.

Compounding: The process where interest is earned on both the principal and previously accumulated interest.

Where:

- r = Interest rate per period

- n = Number of periods

Three essential applications where TVM calculations prove valuable involve retirement planning together with loan amortization and capital budgeting applications. The TI BA II Plus financial calculator serves as a common tool for performing efficient calculations regarding the Time Value of Money problems.

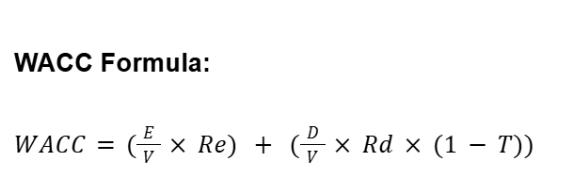

Weighted Average Cost of Capital (WACC)

The average financial expense of asset funding for businesses becomes WACC by uniting debt and equity financing costs. A company employs WACC to analyze if new investments will return more than what capital costs the firm.

Components of WACC:

- Cost of Debt (Rd): The effective interest rate a company pays on its borrowed funds.

- Cost of Equity (Re): The return required by shareholders for investing in the company.

- Market Value of Debt (D): The total value of a company’s outstanding debt.

- Market Value of Equity (E): The total market value of a company’s outstanding shares.

- Tax Rate (T): The corporate tax rate, which affects the after-tax cost of debt.

Where:

- V = Total value of capital (E + D)

- Re = Cost of equity

- Rd = Cost of debt

Companies with higher capital costs together with potential risk factors display elevated WACC values whereas those with stable financial structures present reduced WACC values. Investors together with businesses depend on WACC to evaluate their investment options.

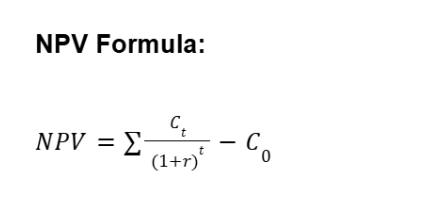

Net Present Value (NPV)

The capital budgeting process uses Net Present Value (NPV) as a main tool to evaluate investment profitability. Project evaluation through NPV requires stakeholders to determine the present worth of anticipated future cash flows and then subtract the starting capital expenditure.

Where:

- Ct = Cash inflow at time t

- r = Discount rate (WACC is often used as r)

- C0 = Initial investment

How to Interpret NPV:

- Positive NPV: The investment is expected to generate profit and should be considered.

- Negative NPV: The investment will result in a loss and should be avoided.

- Zero NPV: The investment breaks even, meaning the return is equal to the cost of capital.

Organizations apply the NPV analysis tool to evaluate the worth of projects and investments in assets and new opportunities. The incorporation of the time value of money in NPV generates a superior method for evaluating investments than basic payback techniques.

Mastering Financial Concepts for WGU C214 OA Success📖

Congratulations! You have completed the necessary financial principles which form the basis of understanding investment risks and valuation methods to make better decisions. The capability to apply CAPM together with systematic and idiosyncratic risk identification and TVM WACC and NPV principles enables effective financial decision-making.

These financial principles found their place as fundamental pillars that support corporate finance operations as well as investment strategy development and individual financial planning practices. Your financial toolkit will contain these fundamental principles which investors and business professionals use for potential return assessments and capital budgeting decisions.

You should study these subjects extensively to succeed in your WGU C214 OA. Success in your exam depends on mastering risk effects on investments and capital costs and NPV methods of evaluating future cash flows.

Continuous practice of your learning material combined with logical application of concepts will help you when you need to refer back to these subjects at any time. You’ve got this! Your last OA in finance faces success and I hope for your ultimate triumph in mastering this subject. Good luck!