WGU D216 OA Study Guide II - 2025 | Agent Relationships and Sarbanes-Oxley Transparency📖

When you are confronted with words such as ‘agents’, ‘principals’, or the rather threatening ‘Sarbanes-Oxley Act’ you might begin to think of a spider web of corporate buzz. But fear not! Sometimes, it is amazing how big words veil interesting ideas that are useful for reshaping perceptions of business processes and responsibility. In this article, we’re about to demystify these ideas and take you on a journey through two essential topics:

- Agent and Principal Relationship: This relationship exists when a principal (e.g., a shareholder) delegates decision-making authority to an agent (e.g., a manager). Proper alignment of interests is crucial to prevent conflicts and ensure effective corporate governance.

- Sarbanes-Oxley Act: Disclosure, Certification, and Monitoring Requirements: The Sarbanes-Oxley Act (SOX) enhances corporate transparency through disclosure of financial statements, certification by executives to ensure accuracy, and monitoring through audits and internal controls to prevent fraud.

Let’s start with a question: have you ever ordered something online and paid a friend to pick it up for you, and think to yourself, ‘Would they go through with it?’ I suppose that is the basic concept of an agent-principal model all about; trust, authority, and responsibility. On the other hand, think of a whole law such as SOX whose basic purpose is to make companies act as responsibly, transparent, and ethically as possible. Combined, these topics define trust and governance in the contemporary business environment.

So buckle up! Whether you’re preparing for WGU D216 OA questions or simply love learning how the corporate world functions behind the scenes, this friendly yet detailed guide will help you connect the dots and see why these concepts matter.

How to Use This Guide for the WGU D216 OA Exam?📖

The D216 Business Law for Accountants OA exam at WGU evaluates your understanding of business law principles, agency relationships, and regulatory compliance. This guide simplifies the key concepts of the agent and principal relationship and the disclosure, certification, and monitoring requirements of the Sarbanes-Oxley Act to help you grasp the topics tested in the exam.

We also provide exam-style questions and practical applications to ensure you’re fully prepared for the questions on the WGU D216 OA exam.

Understanding the Agent and Principal Relationship For D216 OA📝

Imagine you ask a friend to buy something for you. You give them the money and tell them exactly what to get. In this situation, you are the principal, and your friend is the agent. This everyday example mirrors the agent-principal relationship, which is central to understanding business law concepts like those in WGU D216.

In business, the agent-principal relationship refers to a legal arrangement where one party (the principal) authorizes another party (the agent) to act on their behalf. Let’s explore this relationship in detail to see how it works and why it’s so important.

How is the Agent-Principal Relationship Formed?

The relationship between an agent and a principal can be created in several ways:

- Express Agreement: This is the time when the principal and the agent agree on an expressly conveyed business relationship. For instance, a firm may hire a salesperson and agree on certain responsibilities by a legal agreement.

- Implied Agreement: There are occasions when the contract is more implied than expressed, and the behavior of the agent and that of the principal indicates a partnership of some sort. For example, if an employee always enters into bargains on behalf of their employer then an agency relationship can be presumed.

- Ratification: Even if an agent acts without prior authority, the principal can approve or ratify their actions afterward. This retroactive approval establishes an agency relationship.

Regardless of how it’s formed, the relationship is built on trust, clear communication, and mutual understanding.

Fiduciary Duties of Agents

A fiduciary duty means the agent must act in the best interests of the principal. Let’s break down these duties:

- Duty of Loyalty: Agents must prioritize the principal’s interests over their own. For example, a lawyer representing a client cannot take actions that harm the client.

- Duty of Care: Agents must perform their tasks with competence and diligence. For instance, an accountant must prepare financial reports accurately and carefully.

- Duty of Disclosure: Agents must keep the principal informed about relevant matters. Imagine an agent finds out that a product the principal wants to buy is faulty. They must inform the principal immediately.

- Duty of Obedience: Agents must follow the principal’s lawful instructions. If a principal directs an agent to buy a specific product, the agent cannot decide to purchase something else instead.

By following these fiduciary duties, agents ensure that the principal’s trust in them is upheld.

Types of Authority in Agency Relationships

Agents can act on behalf of principals in different ways, depending on the authority they have:

- Actual Authority: This is explicitly given by the principal. For instance, a manager tells their assistant to purchase supplies for the office.

- Express Authority: Clearly stated in words or writing.

- Implied Authority: Power that is not assigned formally but is appended to the position so that the agent can perform his/her tasks. For instance, a store manager may exercise perceived authority in recruiting employees who deserve to be hired.

- Apparent Authority: This arises when the third party develops a belief that a particular agent possesses the authority to act in lawful business for the principal. For instance, if a company permits an employee to engage in public negotiations for contracts, other people may suppose that the employee has the authority anyway and contract it.

Knowledge of such authorities is essential mainly because they define whether the principal is legally tied to the actions of the agent.

Liabilities in the Agent-Principal Relationship

Here’s where things can get tricky. Principals can be held liable for:

- Contracts: If an agent hires himself or herself into a contract, the principal is bound to abide by the contract. For example, suppose a real estate agent enters into a lease agreement in the name of the landlord, the landlord is in breach of the contract.

- Torts (Wrongful Acts): Sometimes, if an agent inflicts injuries on others in the course of performing his/her duties, the principal will be deemed liable. For instance, in the event that a delivery driver, who works for the company (principal), gets into an accident while on duty as an agent of the firm, then the claim can be made against the company.

- Principal’s Duty to Indemnify: The principal shall bear the costs or losses that the agent incurred while conducting the permitted functions. For instance, if the sales agent has expended any amount on traveling, the principal is supposed to compensate the amount.

These are some of the reasons; why more emphasis should be paid to the selection of reliable agents and the specification of their functions necessary for principal.

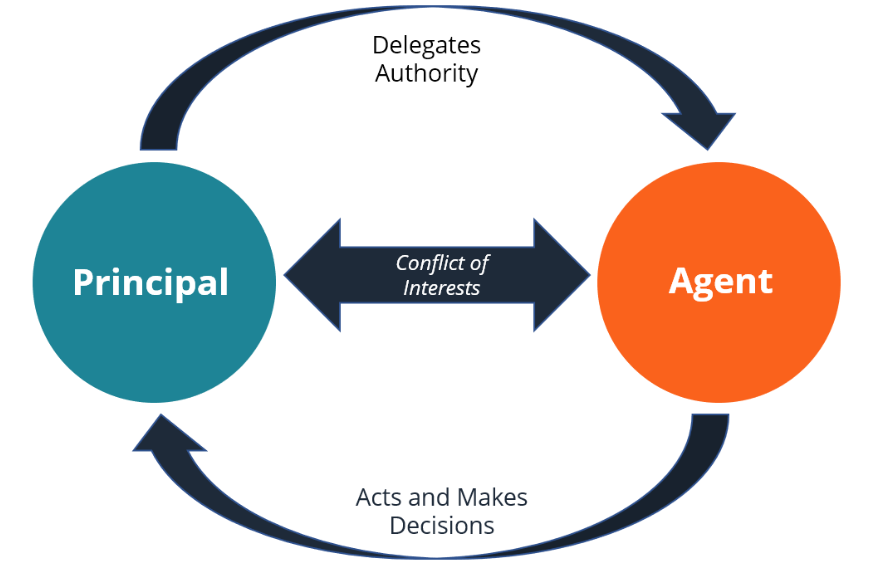

The Principal-Agent Problem

It can be however observed that rather than working for the best interest of their principals agents sometimes may not do the right thing. There is a phenomenon called the principal-agent problem. For instance, a manager (agent) may make decisions that will be advantageous to his /her career at the expense of the company (principal). This problem arises due to:

- Conflicts of Interest: When agents prioritize their interests over the principal’s.

- Information Asymmetry: Agents may have more information than the principal, leading to decisions that the principal wouldn’t approve of.

To address this, businesses often introduce monitoring systems, performance incentives, or regular reporting to align the agent’s actions with the principal’s goals.

Ending the Agent-Principal Relationship

Agency relationships don’t last forever. They can end in several ways:

- Mutual Agreement: The relationship between the two parties is dissolved for mutual consent.

- Completion of Task: The agent completes a particular task for which they were contracted to perform.

- Revocation or Renunciation: The principal in independent legal actions may withdraw the agent’s power actually of representation, or the agent may terminate the power of representation.

- Operation of Law: Since it is an exclusive formula, it cannot be transferred to another company; Some circumstances include the death or bankruptcy of either of the partners.

Knowledge with regard to how and when an agency relationship is to be terminated assists in avoiding conflicts.

Real-World Impacts of the Agent-Principal Relationship

The agent-principal relationship significantly affects business transactions and strategy. Here are some practical examples:

- Binding Contracts: If an agent signs a deal with apparent authority, the principal is bound by it, even if the agent exceeds their actual authority. This emphasizes the importance of clear communication between principals and agents.

- Trust and Reputation: A breach of fiduciary duties, such as failing to disclose critical information, can harm the principal’s reputation and lead to financial losses.

- Business Strategy: Companies must carefully design policies and controls to manage agency costs and prevent conflicts of interest.

Why is the Agent-Principal Relationship Important For D216 OA?

In business transactions, this relationship shapes everything from contracts to liability. It ensures that the actions of agents are legally binding and that principals are protected when agents act within their authority. For students studying WGU D216, understanding this concept is foundational for grasping broader business law principles.

Study Tips for WGU D216

- Focus on key terms like “fiduciary duty,” “actual authority,” and “principal-agent problem.”

- Use diagnostic questions provided in your coursework to test your understanding.

- Review case studies where agency law played a critical role in business decisions.

Conclusion

The agent-principal relationship is like a partnership built on trust, communication, and clear expectations. By understanding how it works, students can better appreciate its impact on business operations and legal frameworks. Whether you’re studying for WGU D216 OA questions or exploring business law in depth, this relationship is a cornerstone of your learning journey.

From understanding trust-based partnerships to ensuring legal accountability, the Sarbanes-Oxley Act takes transparency and oversight in corporate practices to the next level.

Understanding Disclosure, Certification, and Monitoring Requirements of the Sarbanes-Oxley Act For D216 OA📝

There have been other incidences where leading companies such as Enron and WorldCom were involved in fraudulent practices and misleading financial statements. To try and regain that lost confidence the US government passed what is known as the Sarbanes Oxley Act (2002). This historic legislation has set high standards of corporate practices, reporting activities, governance, and fair reporting of business operations.

It is now time to introduce the main components of SOX – Disclosure, Certification, and Monitoring FRA requirements and appreciate the importance of each in detail.

What is the Sarbanes-Oxley Act?

The Sarbanes-Oxley Act is a federal law that aims to provide reforms that help in increasing the reliability of corporate disclosures. Its primary goals are to:

- Prevent investors from being defrauded in the financial management of organizations in which they have invested.

- To improve the quality of financial reports, Australia Assignment Help is the agency you can rely on.

- Holds corporate executives responsible for the purity of their companies’ financial statements.

SOX affects all corporations with a recorded stock in the US, company officials, and auditing firms or partners preparing auditing reports for such companies.

Key Disclosure Requirements

SOX also focuses on disclosure by requiring extensive disclosures of financial information. These disclosures afford investors and regulators relevant timely and accurate financial information hence minimizing cases of fraud and deceit. Let’s explore these requirements in detail:

- Real-Time Disclosure:

- Each enterprise is to report material changes in its financial position and the results of its activities without delay. For instance, where the revenue collection by a firm is affected significantly by some circumstance in the market, the firm is supposed to give this notice immediately so that the investors are not given a wrong impression.

- Real-time reporting fosters confidence and gives its stakeholders the necessary information for decision-making.

- Internal Controls Over Financial Reporting (ICFR):

- Entities and businesses must implement, write, and review their own internal controls. These controls are measures adopted with the objective of safeguarding the information provided in the financial statements against probable fraud and all possible errors.

- For instance, a retail firm may come up with a program that checks the receipt of the sales with the records of the inventory to come up with some anomalies.

- Annual and Quarterly Reporting:

- The SOX law requires companies to prepare and submit their annual and quarterly reports of financial data at high levels of accuracy and comprehensiveness. These reports are ascertained by external auditors and give out the financial position of the company.

Certification by Executives

SOX places significant accountability on corporate executives, requiring them to personally vouch for the accuracy and integrity of financial reports. This is achieved through mandatory certifications:

- CEO and CFO Certifications:

- The company’s CEO and CFO must provide personal certification regarding any financial reports containing the statement that they are accurate complete and prepared in accordance with the applicable laws.

- Corporate fraud protection means that chief officers cannot claim they were unaware of some false entries or manipulations. For instance, if a CFO signs a certificate on a financial statement knowing that it contains some information that is not true, they are legally bound.

- Accountability for Internal Controls:

- CEOs and CFOs are required to assess the effectiveness of internal controls over financial reporting and disclose any weaknesses.

- If gaps are identified, they must implement corrective measures to strengthen the controls and prevent future issues.

- Penalties for False Certification:

- Managers receive severe penalties if they sign off on false financial statements. Such penalties include fines and imprisonment and they act as a great discourage mechanism against deceitfulness.

As much as SOX has its advantages, its provisions for demanding an executive certification go a long way in making a point that the buck stops with the chief officers and that they are answerable to the law.

Monitoring and Oversight Requirements

To enforce compliance with SOX, the Act establishes robust monitoring mechanisms. These mechanisms aim to ensure that companies adhere to the rules and maintain transparency in their financial operations. Key components include:

- Public Company Accounting Oversight Board (PCAOB):

- The PCAOB was established under SOX to play the role of supervising the audits of public companies. It decides standards for audits, investigates and regulates firms that conduct the audits, and ensures compliance with SOX regulations.

- For instance, the PCAOB is in the constant practice of inspecting audit firms with the aim of assessing their compliance with the expected standards and methods.

- Auditor Independence:

- SOX provides stringent provisions with regard to the avoidable relationship that may exist between auditors and companies. For example, auditing firms that are in practice are supposed to avoid rendering certain non-auditing services like consulting to the audited entities.

- This is because auditors can only make the required assessment when they are independent and impartial in the discharge of the assigned tasks.

- Whistleblower Protections:

- SOX affords legal rights to employees who blow the cover of their employers in cases of fraud or legal violation. Employees who report unlawful conduct receive protection against practices like firing or harassment.

- For example, if an employee uncovers fraudulent accounting practices and reports them to regulators, the company cannot retaliate against them.

- Periodic Audits and Reports:

- Companies must undergo regular audits to verify the effectiveness of their internal controls. These audits help identify risks and ensure compliance with SOX requirements.

- For instance, a manufacturing company might conduct an audit to ensure its cost accounting processes are accurate and transparent.

The Importance of SOX Compliance

Compliance with the Sarbanes-Oxley Act is essential for maintaining trust and integrity in the corporate world. Here’s why it matters:

- Restoring Public Trust:

- The Act reassures investors and stakeholders that companies are committed to ethical practices and transparency. This confidence is crucial for the stability of financial markets.

- Reducing Fraud Risks:

- By enforcing rigorous controls and monitoring, SOX minimizes the likelihood of fraudulent activities and financial mismanagement.

- Improving Decision-Making:

- Accurate and reliable financial data enables businesses to make informed strategic decisions and allocate resources effectively.

- Enhancing Market Stability:

- SOX contributes to a stable and trustworthy financial market, benefiting the economy as a whole.

Challenges of Implementing SOX

While SOX brings numerous benefits, compliance can be challenging for companies. Key challenges include:

- High Costs:

- Implementing and maintaining SOX-compliant controls and audits can be expensive, particularly for smaller companies. For instance, hiring external auditors and updating internal systems requires significant investment.

- Complexity:

- The Act’s provisions are extensive and require companies to dedicate substantial time and resources to understand and implement them fully.

- Resource Allocation:

- Companies may need to reallocate resources, such as personnel and technology, to achieve compliance. This shift can strain other areas of operations.

Despite these challenges, the long-term benefits of SOX compliance often outweigh the initial costs, particularly in terms of reduced fraud risks and enhanced investor confidence.

Real-World Impact of SOX

The Sarbanes-Oxley Act has transformed the corporate landscape, promoting transparency, accountability, and ethical behavior. Consider these examples:

- Preventing Fraud:

- Companies now face greater scrutiny, making it harder for fraudulent activities to go unnoticed. For example, stricter auditing standards and internal controls reduce opportunities for financial manipulation.

- Restoring Investor Confidence:

- Enhanced transparency and accountability have reassured investors, encouraging greater participation in financial markets.

- Global Influence:

- The success of SOX has inspired similar regulations in other countries, highlighting its effectiveness in improving corporate governance worldwide.

Importance For D216 OA

The Sarbanes-Oxley Act represents a critical step forward in corporate governance, emphasizing the importance of transparency, accountability, and ethical practices. Its disclosure, certification, and monitoring requirements ensure that companies operate responsibly and provide accurate financial information. For students studying WGU D216 OA questions, understanding SOX is essential for appreciating how robust legal frameworks can safeguard investors and promote trust in financial systems. By adhering to SOX principles, companies not only meet legal obligations but also contribute to a more stable and trustworthy economic environment.

Tired of reading blog articles?

Let’s Watch Our Free WGU D216 Practice Questions Video Below!

Mastering the Foundations of Accountability: Final Thoughts for WGU D216 Success 📄

Understanding the Agent and Principal Relationship and the Sarbanes-Oxley Act’s disclosure, certification, and monitoring requirements is more than just grasping legal jargon; it’s about appreciating the structures that uphold trust and transparency in the corporate world. These topics may seem intricate at first, but they are critical to understanding how businesses operate ethically and responsibly.

As you prepare for your final objective assessment (OA) in WGU D216, take the time to fully absorb these concepts. Whether it’s identifying the fiduciary duties of an agent or unpacking the role of executive certifications under SOX, these principles are not only testable but also foundational to business law.

Remember, the journey doesn’t end with passing the exam. These concepts will serve as a cornerstone for your understanding of corporate governance and accountability, shaping your future endeavors in business and beyond.

Good luck with your WGU D216 OA! With preparation and focus, you’ve got this!